|

| Evelyn Hockstein, Nathan Frandino/Reuters |

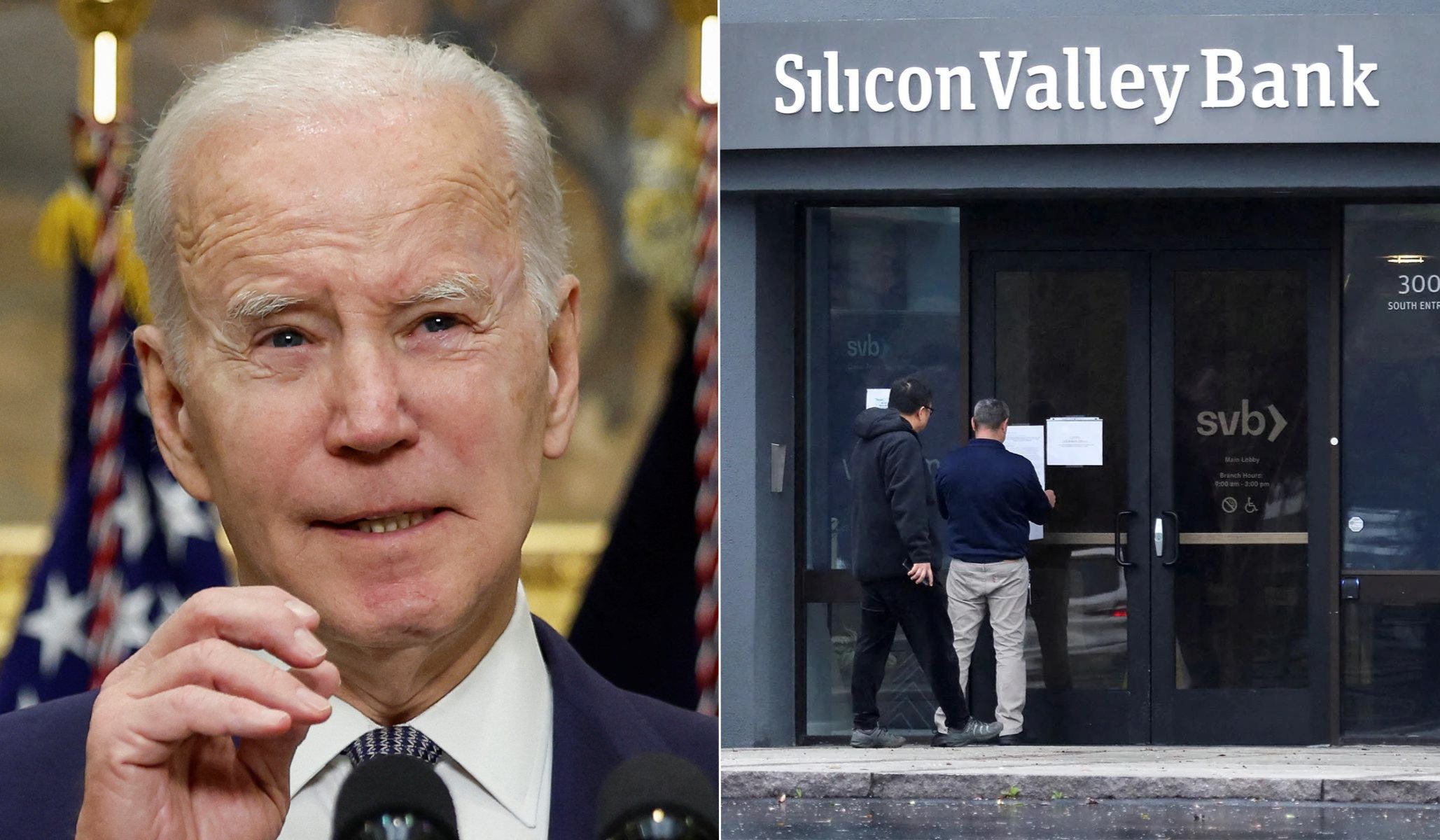

On the menu today: Suddenly, no one is all that certain about the financial health of regional banks in the United States. Over the course of the weekend, the collapse of Silicon Valley Bank went from a big financial story that might warrant an explainer in this newsletter to a big national story with potentially far-reaching ramifications for the U.S. economy. The collapse of the bank most tied into Silicon Valley’s high-flying world of venture capital comes on the heels of the sudden end of two banks tied into the cryptocurrency industry. The government is also pledging to guarantee the full deposits of New York-based Signature Bank; and last week, San Diego-based Silvergate Bank announced it was winding down operations and liquidating its holdings. What do those two latter banks have in common? They were the top two U.S. banks tied into cryptocurrency. In Silicon Valley’s giant game of musical chairs, the music just stopped, and everybody’s scrambling to make sure they still have a seat. The Biden administration’s solution is to throw the traditional limit on FDIC guarantees out the window and pledge that the U.S.-government-backed FDIC will make everyone whole again. Moral hazard is back, baby.

Financial-Health Scare

If you’re old enough, you’ll remember television commercials for banks ending with the statement, “member, FDIC.” This is referring to the Federal Deposit Insurance Corporation, established in 1933, designed to ensure that if you put your money into a bank and the bank went out of business through bad management, your deposit would be returned to you by the FDIC up to a certain amount. When I was growing up it was $100,000; in 2008, that threshold was raised to $250,000.

For most people, the idea of having more than $250,000 in their bank accounts is a distant dream. But businesses have bank accounts, too, and a lot of businesses and venture-capital firms in Silicon Valley kept their money in the aptly named Silicon Valley Bank. SVB boasted that it provided “banking services to nearly half of all venture-backed technology and life-science companies in the United States, according to its website. Silicon Valley Bank was also a bank to more than 2,500 venture capital firms, including Lightspeed, Bain Capital and Insight Partners. It managed the personal wealth of many tech executives and was a stalwart sponsor of Silicon Valley tech conferences, parties, dinners and media outlets.”

In fact, as of the end of last year, 93 percent of the money in Silicon Valley Bank was above that $250,000 threshold and not covered by the FDIC. Yet the bank had a seemingly sterling reputation. One month ago, SVB ranked 20th in Forbes magazine’s annual America’s Best Banks list. (Note that this is Forbes, not a continuation of the Fortune magazine-cover curse.) --->READ MORE HERE

| AP Photo/Jeff Chiu |

Economists warn that President Biden’s extraordinary action to make more than $200 billion in additional government funds available to customers whose deposits were not covered by federal insurance at two collapsed banks is the first step toward government control of the banking system.

The Federal Deposit Insurance Corp. (FDIC) covers deposits up to $250,000 per account to prevent bank runs and failures. On Sunday, Mr. Biden approved a higher limit to cover the huge amount of uninsured deposits at the two banks.

That guarantee potentially stretches the FDIC’s Deposit Insurance Fund (DIF) to its breaking point and establishes a “moral hazard” precedent that the government will bail out any bank of significant size.

It is also the most extensive government intervention in the banking system since the 2008 financial meltdown.

Steve H. Hanke, a professor of applied economics at Johns Hopkins University who served on President Reagan’s Council of Economic Advisers, said it moves the banking sector closer to a public utility or government-backed entity.

“With the Biden bank bailout, and it is a bailout, banking is becoming a government-backed business — if that’s what you call a business,” he said. “And if that’s not bad enough, the Biden administration has just injected another massive infusion of moral hazard into the banking system, as have past Republican and Democratic administrators. Who picks up the moral hazard tab? Taxpayers do.”

A “moral hazard” is when banks or other entities are incentivized to take more risk because someone else, such as taxpayers, will foot the bill if things go badly. Moral hazard risks become even higher if the institution is seen as “too big to fail,” which would justify tighter government regulation and control over the bank market. --->READ MORE HEREFollow links below to relevant stories:

+++++SVB, Signature Bank and Credit Suisse donated $1.2M to Dems since 2017+++++

+++++Breitbart Business Digest: Silicon Valley Bank’s Supersized Depositors Got Bailed Out+++++

If you like what you see, please "Like" and/or Follow us on FACEBOOK here, GETTR here, and TWITTER here.

No comments:

Post a Comment