3 mass layoff announcements in the past 3 hours, meanwhile 12 hikes priced in through February. pic.twitter.com/7Q4wfP9J79

— zerohedge (@zerohedge) June 14, 2022

... and will revise its 2% inflation target higher, a move which will send every risk asset - from high-beta trash and meme stonks, to blue-chip icons, to bitcoin and cryptos limit up.

To remind readers of this coming phase shift, we most recently warned in June that "at some point Fed will concede it has no control over supply. That's when we will start getting leaks of raising the inflation target"...

At some point Fed will concede it has no control over supply. That's when we will start getting leaks of raising the inflation target

— zerohedge (@zerohedge) June 21, 2022

Well, it turns out that we were right, and not just about the coming mass layoffs, but also about the inflation target leaks. But first, lets back up a bit.

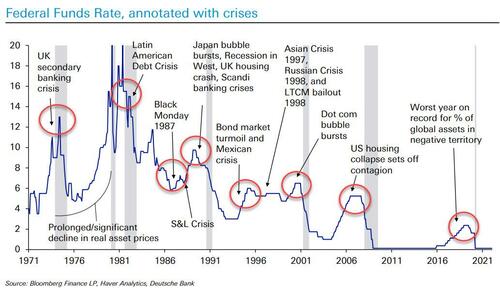

A little over one year after nobody expected the Fed would be hiking rates like a drunken sailor until some time in late 2023 or 2024, it has now become fashionable to not only predict that the Fed will keep hiking rates at every FOMC meeting and at the fastest pace since the near-hyperinflation of the 1980s, but that the central bank will somehow manage to avoid a hard landing (i.e., the hiking cycle won't end in a recession or depression), even though every single Fed tightening cycle since 1913 has ended in disaster.

An example of this was the statement by former Fed vice chair (and PIMCO's "twice-revolving door") Rich Clarida, who told CNBC that "failure is not an option for Jay Powell," adding that "I think they're going to 4% hell or high water. Until inflation comes down a lot, the Fed is really a single mandate central bank."

"Failure is not an option for Jay Powell," says Former Fed Vice Chair Richard Clarida. "I think they're going to 4% hell or high water. Until #inflation comes down a lot, the Fed is really a single mandate central bank." pic.twitter.com/4hfLCVWZDP

— Squawk Box (@SquawkCNBC) September 9, 2022

Of course, if one could hike rates in a vacuum that could work - after all, Clarida himself, who admits he got this year's soaring inflation dead wrong when he was still a daytrading god and part oft he Fed in 2021, said that the Fed may as well have just one mandate, namely to tame inflation. But what so few seem to recall is that the Fed is "hiking to spark a recession", or as CNBC's Steve Liesman put it, there is no such thing as "immaculate rate hikes" meaning that rate hikes have dire tradeoffs in other sectors of the economy. In other words, if the Fed's intention is to spark a recession, it will spark a recession... leading to millions of Americans losing their jobs, something which even Elizabeth Warren appears to have grasped.

SENATOR WARREN SAYS SHE IS VERY WORRIED THAT FED IS GOING TO TIP ECONOMY INTO RECESSION

— zerohedge (@zerohedge) August 28, 2022

Looks like someone didn't read Chairman Doom's speech https://t.co/wQALP1aA3Y

Yet due to the recency bias of Biden's trillions in stimmies, and a world where workers - whether working form home or the office - have virtually all the leverage, few today can conceive of a world where inflation is zero or negative and is instead replaced with millions in unemployed workers, an outcome which one could (or rather should) say is even worse for the ruling democrats than roaring inflation. At least, with runaway prices, most people have a job and their wages are rising (at least nominally, if not in real terms).

However, the higher rates rise, the closer we get to that inevitable moment when the BLS - unable to kick the can any longer - admits what has been obvious to so many for months: the US is facing a labor crisis of epic proportions with millions and millions of mass layoffs. And for those to whom it is not yet obvious, we urge to read a WSJ op-ed published by none other than Jason Furman, who is not some crackpot republican but Obama's own top Economic Adviser from 2013-2017 and currently economic policy professor at Harvard. --->READ MORE HERE

If you like what you see, please "Like" and/or Follow us on FACEBOOK here, GETTR here, and TWITTER here.

No comments:

Post a Comment